Launch of the 2025 International Supply Chain Conference of Chinese Cuisine: Supply Chain Becomes the Key to Breakthrough, Marking the "First Year of Industrialization" for Chinese Cuisine’s Global Expansion

Guangzhou, China, June 23, 2025 (GLOBE NEWSWIRE) -- The "2025 International Supply Chain Conference of Chinese Cuisine," hosted by Wuhan Liangzhilong Food Inc., officially opened at Zone D of the Canton Fair Complex in Guangzhou. The event brought together representatives from 17 industry associations, over 100 supply chain platforms, and leading chain restaurant enterprises to explore how businesses can leverage localization, standardization, and digitalization strategies to break into international markets during what is being hailed as the inaugural year of Chinese cuisine’s global supply chain expansion. The focus is shifting from simply "selling flavors" to "selling the entire supply chain."

Chinese Cuisine’s Supply Chain Expansion Accelerates: Dual Transformation in Market Potential and Industrial Model

According to data from Frost & Sullivan, the global foodservice market is projected to reach USD 3.8 trillion by 2026, with Chinese cuisine's share expected to grow to 10.8%. The internationalization of Chinese cuisine is now outpacing the overall growth of the global foodservice sector, with supply chain systems emerging as a new driver of this momentum.

From early mom-and-pop restaurants in Chinatowns to today’s globally expanding chain brands powered by supply chain advantages, the global push of Chinese cuisine is undergoing a transformation—from selling just the taste to exporting a comprehensive supply chain. This quiet revolution in Chinese cuisine’s global reach is not only redefining its international competitiveness but also marking a significant step toward the industrialization of Chinese food on the world stage.

A Golden Era of Global Expansion for Chinese Cuisine

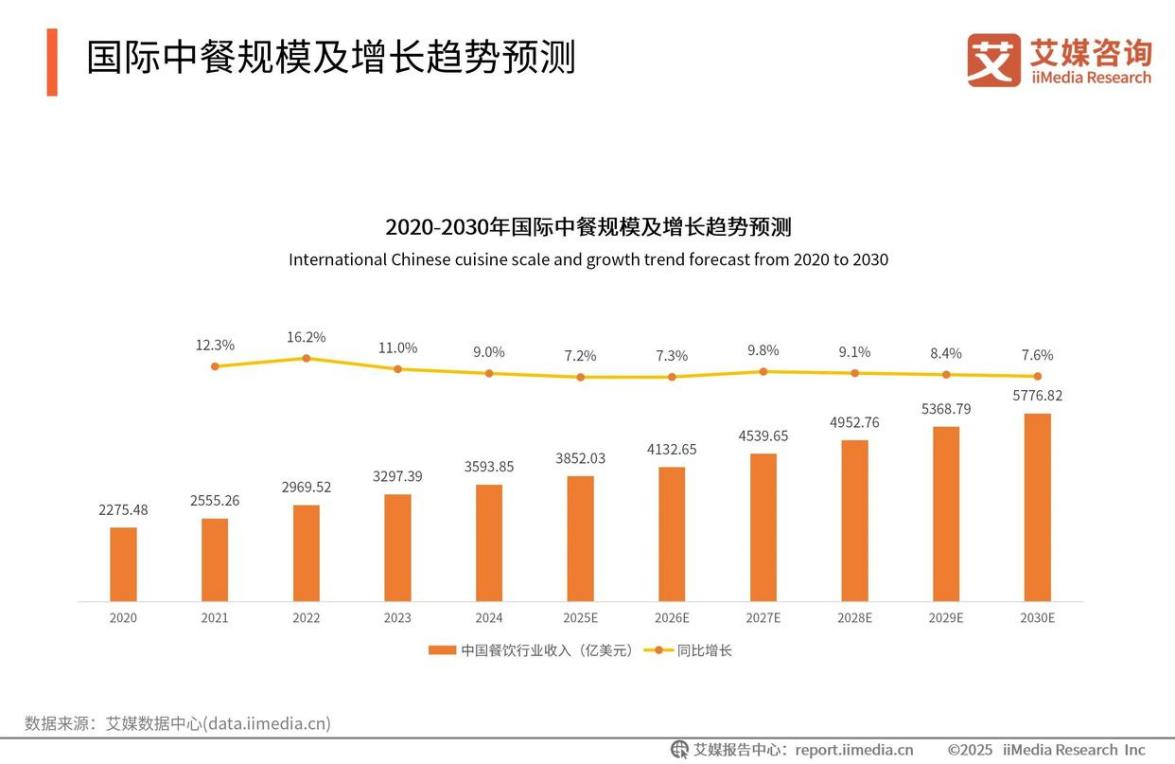

According to data from iiMedia Research, the international Chinese cuisine market grew from RMB 227.55 billion in 2020 to RMB 359.39 billion in 2024, demonstrating a steady upward trajectory.

Acceleration of Chinese Cuisine’s Global Expansion: From Individual Efforts to Systematic Supply Chain Export

Leading brands are leveraging supply chains as strategic levers to penetrate global markets. Haidilao, for example, has opened over 100 outlets across 14 countries and regions including Singapore, the United States, and Japan. Its overseas supply chain hubs not only provide raw ingredients but also export the “Shuhai” central kitchen model, enabling end-to-end control from ingredient sourcing and centralized processing to cold-chain logistics.

Nong Geng Ji is using its supply chain strengths to directly supply overseas markets with ingredients such as chili peppers from Eastern Guangxi, chicken from Hengyang, fish from Chenzhou, and cured meats from Western Hunan—all delivered through cold-chain logistics. Tan Yu has established a hybrid model combining “core standardization with regional adaptation,” in which core seasonings are distributed from central kitchens while bulk ingredients are sourced locally. By early 2025, Tan Yu had surpassed 350 outlets worldwide.

Policy Tailwinds Accelerate Chinese Cuisine’s Internationalization

Favorable policies are propelling the globalization of Chinese cuisine. In 2024, China’s Ministry of Commerce and eight other government agencies jointly issued the Guiding Opinions on Promoting High-Quality Development of the Catering Industry, explicitly encouraging the internationalization of Chinese food. The directive supports catering businesses in expanding overseas, promotes the deployment of Chinese chefs abroad, facilitates the export of food ingredients and materials, encourages Chinese culinary schools to establish international partnerships, and backs domestic restaurant rating agencies in conducting international evaluations to enhance the global influence of Chinese cuisine assessments.

Global Demand Aligns with the Outbound Expansion of Chinese Cuisine Brands

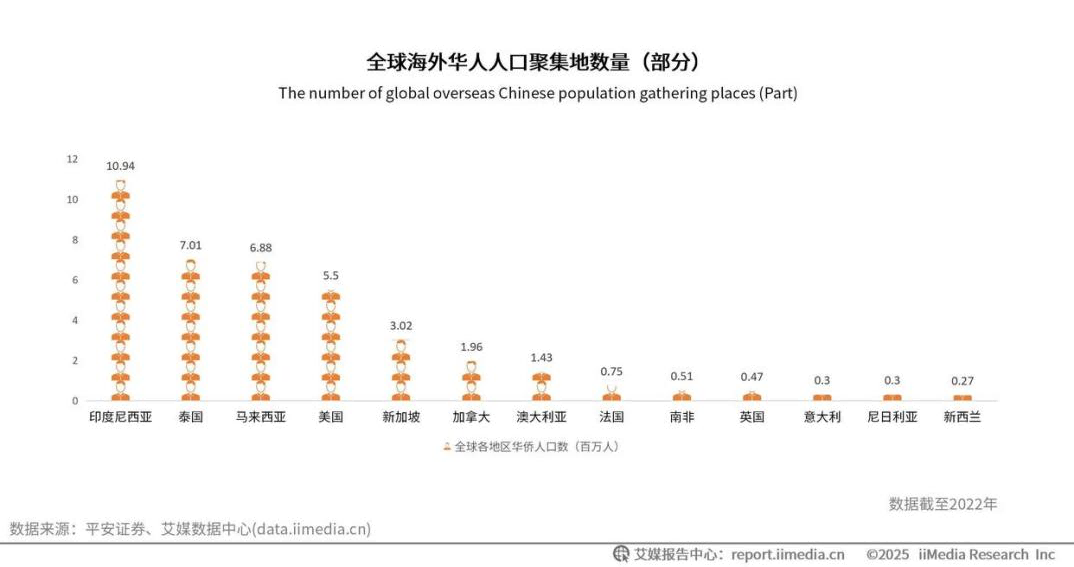

The growing global demand for diverse culinary experiences is resonating with the international ambitions of Chinese restaurant brands. In 2024, many Chinese foodservice enterprises faced shrinking per-customer spending and declining profit margins, with intensifying competition in the domestic market. In contrast, the expanding overseas Chinese population is providing a stable consumer base for Chinese restaurant chains, especially in high-concentration regions such as Southeast Asia and the United States.

According to the 2025 White Paper on the Global Expansion of Chinese Restaurant Chains, Asian cuisine accounts for 12.6% of the overall U.S. foodservice market and continues to grow. Within this category, Chinese cuisine holds the largest share at 37.21%. Notably, 33% of Americans report eating Chinese food at least once a month.

Today’s Overseas Chinese Cuisine Market: From Fragmented Competition to Group-Driven Expansion Backed by Supply Chains

The overseas Chinese food market has evolved far beyond fragmented, small-scale competition. The new landscape is defined by group-level expansion underpinned by robust supply chain systems. At its core, this transformation represents a shift in Chinese cuisine’s global role—from a vehicle of cultural export to a scalable model of industrial supply chain export.

From Selling Dishes to Exporting Entire Supply Chains

“To establish a foothold overseas, building a local supply chain is critical to success,” said Yang Ou, Vice President of Happy Lamb. For example, Happy Lamb sources locally for each market: Belgian Blue sheep in Australia, Welsh lamb in the UK, and purebred Sunite sheep from Inner Mongolia in China. All meat is processed using a 0–4°C cell-lock freshness preservation technique, maintaining consistent low temperatures throughout transport via air freight. This strong domestic and international supply chain infrastructure has made Happy Lamb a benchmark for successful Chinese hotpot expansion overseas.

If 2023 marked the inaugural year of Chinese cuisine’s international push, and 2024 was the year of acceleration, then 2025 is poised to become the foundational year for the outbound development of Chinese food supply chains.

This next phase is not merely about exporting ingredients; it involves building a fully integrated system centered on standardization, industrialization, and scalability. Unlike the traditional model of localized sourcing and basic menu replication, the essence of supply chain globalization lies in the comprehensive export of China’s foodservice industrial capabilities.

A Comprehensive Ecosystem, Not Just Ingredient Export

According to Zhou Pengbang, advisor at the Singapore Institute of Management, key elements of an internationalized supply chain include:

Customized overseas menus tailored for regional preferences

Food safety protocols and international certification systems

Localized supply chains involving regional partners, processors, logistics, and warehousing

A growing pool of international supply chain talent

The goal is full-chain export—not the relocation of individual components. Brands such as Cha Bai Dao and Mixue Bingcheng have adopted centralized kitchen models abroad, enabling mass production and standardized distribution. This enhances quality control, reduces costs, and improves operational efficiency.

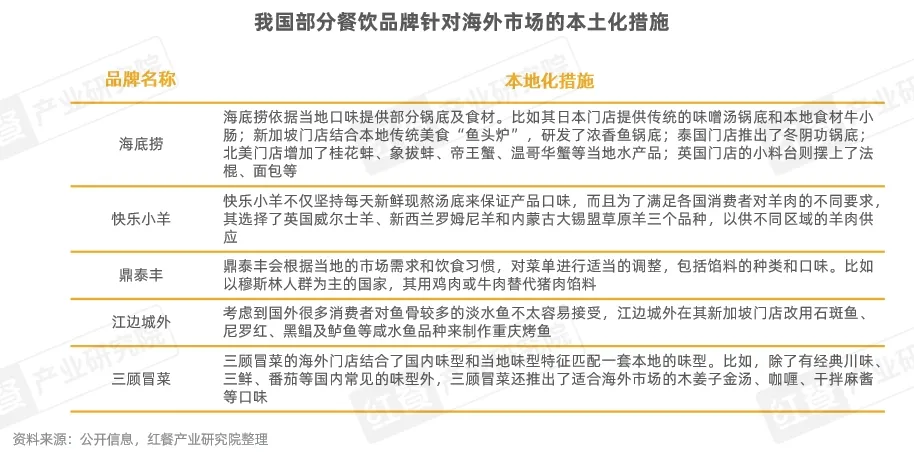

Critically, these brands focus on local adaptation, not simple replication. For instance, Haidilao offers unique regional menu items: spicy milk hotpot in Singapore, oat milk hotpot in Indonesia, and Tom Yum Goong hotpot in Thailand.

In short, Chinese cuisine’s global supply chain expansion is not about shipping pots and pans abroad—it's about replicating China’s entire foodservice industrial system across borders. This shift is transforming Chinese cuisine from a craft-based industry dependent on chefs’ skills into a modern sector driven by industrial standards.

Three Key Trends Shaping the Globalization of Chinese Cuisine Supply Chains in 2025

As of 2025, three emerging trends are defining the future of Chinese food supply chains abroad:

Localization – The key to cultural and market integration

Localization is the first engine of market penetration. It encompasses more than product adjustments; it includes cultural alignment and organizational adaptation. Chinese food brands are improving their adaptability in overseas markets through localized product offerings, workforce development, and supply chain strategies.

Standardization – Ensuring quality, consistency, and scalability

By establishing centralized kitchens and unified production protocols, brands can maintain consistent taste and service levels while accelerating global rollout.

Digitalization – Empowering real-time control and intelligent supply chain management

Digital technologies are being deployed to streamline inventory, enhance quality control, and optimize logistics, driving efficiency and responsiveness throughout the global supply chain.

Standardization Enables Global Replicability: Building a Controllable, Scalable, and Profitable Operating Model

Standardization serves as the foundational logic for the rapid expansion of Chinese restaurant brands. Leading enterprises are leveraging centralized kitchens and pre-prepared food systems to unify culinary processes, quality control standards, and operating procedures. This approach creates a closed-loop, high-efficiency supply chain that can be consistently replicated across markets.

Digitalization Reshapes Operational Efficiency: From Experience-Driven to Data-Driven Management

Digital technology is emerging as the core engine of next-generation supply chains, significantly enhancing the global operational capabilities of Chinese food brands. By integrating intelligent algorithms, blockchain, and other advanced technologies, companies are now able to respond more swiftly and accurately to market dynamics.

Many enterprises have already achieved full-chain data visualization—from farm to table—allowing consumers to scan a code and instantly access detailed information about ingredient origins and processing methods. In an increasingly complex international environment, data-driven supply chains provide brands with stronger risk resilience and more informed decision-making capabilities.

Industry Leaders Converge in Guangzhou to Explore Breakthrough Strategies and Innovative Models for Global Expansion

Despite the strong momentum behind Chinese cuisine’s global supply chain expansion, the industry still faces considerable challenges—including differences in food safety regulations across countries, labor policy constraints, and local taste preferences.

To address these issues and accelerate the pace of globalization, the 2025 International Supply Chain Conference of Chinese Cuisine was held on June 22 at Zone D of the Canton Fair Complex in Guangzhou. The event convened representatives from more than 17 industry associations, over 100 supply chain platforms, and numerous chain restaurant brands. Attendees gathered to share insights on international market entry, exchange best practices, and work toward transitioning Chinese cuisine from simply “going global” to truly “taking root” worldwide.

Wang Jue Wuhan Liangzhilong Food Inc. wangjue-at-lzl98.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.