Modives and IDScan.net Disrupt Auto Industry by Exposing Widespread Transaction Risks

CheckMyDriver prevents millions in losses, catches ID and insurance compliance issues in more than 22.5% of auto transactions.

Our DIVE technology plus Modivesʼs remediation and insurance capabilities create an industry-leading workflow that reduces fraud, speeds transactions, and protects the bottom line.”

CHARLOTTE, NC, UNITED STATES, October 16, 2025 /EINPresswire.com/ -- CheckMy Driver prevents millions in losses, catches ID and insurance compliance issues in more than 22.5% of auto transactions— Jimmy Roussel, CEO of IDScan.net.

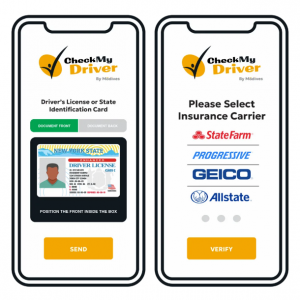

Modives today announced industry-shifting results six months after leveraging IDScan.netʼs Digital Identity Verification Engine DIVE for identity verification in CheckMy Driver, the Modives application for auto transactions.

Modivesʼs results showed that 22.5% of auto transactions it verified through CheckMy Driver involved either a fake ID or insurance that was inactive, inaccurate, or inadequate, exposing substantial risks for auto dealers, rental companies, service departments, and financial institutions.

To combat the rise of synthetic identity fraud, a threat TransUnion estimates at a $3.3B loss exposure for lenders, CheckMy Driver leverages advanced ID verification to validate identity documents through a partnership with IDScan.net.

“Fraud in auto transactions is evolving quickly, and winning that fight requires more than detection… it requires an end-to-end approach,ˮ said Jimmy Roussel, CEO, IDScan.net. “Our DIVE technology plus Modivesʼs remediation and insurance capabilities create an industry-leading workflow that reduces fraud, speeds transactions, and protects the bottom line.ˮ

Since launching the integration, the solutionʼs DIVE technology has used forensic checks to flag sophisticated fraud and deepfake imagery, which has led to:

-Identifying 2.5% of all examined IDs as fraudulent

-Preventing millions of dollars in potential losses during auto transactions

-Finding an additional 20% of auto insurance policies verified or monitored during transactions were inactive, inaccurate, or inadequate, creating coverage gaps, and working with those drivers to get their policies back in compliance through its automated remediation process and embedded insurance solutions from Modives' 48-state licensed insurance agency

“In our fast-paced, high-volume dealership, thereʼs no time to waste,ˮ said Suzanne Cochrane, general manager at Helms Bros. Mercedes in Queens, NY. “But CheckMy Driverʼs process made it easy to verify our customersʼ insurance and identity, fitting right into our flow and catching dozens of insurance policies that could put us at substantial risk. All it takes is one mistake, and we could be hit with a crippling loss or FTC violation. CheckMy Driver protects us from those risks.ˮ

CheckMy Driver can either be used in person during transactions, including leasing/buying a car, test drives, or service loaner rentals, or it can be completed along with ID verification before an appointment through CheckMy Driverʼs Express Check-In capability, sending drivers text messages and email links to complete verification before their appointment.

About Modives

CheckMy Driver is the only automated, AI-driven application that connects instantly with your customer’s insurance carrier to verify their coverage is active, accurate, and adequate, delivering actionable business results instead of just data and more work.

CheckMy Driver’s monitoring feature keeps an eye on their policy with live data, regularly verifying that it’s unchanged and that your asset remains protected. When it finds an issue, CheckMy Driver works directly with the customer to fix the problem, using its automated messaging process for remediation, including embedded insurance options from Modives Insurance Agency.

For more information or for press inquiries, please contact MediaRelations@Modives.com or visit Modives.com.

About IDScan.net

IDScan.net is the leading AI-powered identity verification platform focusing on age validation and fraud reduction for high compliance industries. We perform more than 18,000,000 ID and identity-related transactions monthly for more than 7,500 customers, including Hertz, AMC Theatres, Simmons Bank, First Arkansas Bank, MRI Software, and more.

Jillian Kossman

IDScan.net

+1 714-353-1769

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.